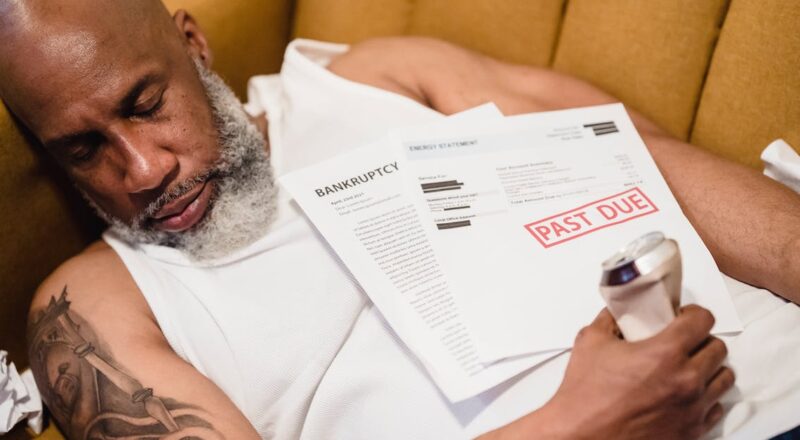

Filing for insolvency can be an overwhelming experience, which can take a financial and emotional toll on many individuals and businesses. Insolvency can have hidden costs, from legal fees to credit score penalties, that can add significantly to the burden of debt. While it may be unavoidable for some, there are steps that can be taken to minimize these costs, giving those struggling with debt a better chance of getting back on their feet. Understanding the costs associated with insolvency can help individuals and businesses make informed decisions about their financial future.

Legal Fees: An Unexpected Cost of Insolvency

Legal fees are one of the hidden costs of insolvency that can be difficult to anticipate. It is important to understand that legal advice and representation is essential throughout the insolvency process. As such, obtaining a lawyer who specializes in insolvency law is critical. This lawyer will help you navigate the complexities of the legal process and protect your rights. Not only will the legal fees for such services add up, but you may also incur additional costs for court filing fees, court appearances, and related expenses.

Fortunately, there are ways to reduce legal fees when going through insolvency. It is important to keep in mind that insolvency proceedings are complex and require the expertise of a qualified attorney. However, there are steps you can take to reduce legal expenses. Consider shopping around to find the most qualified and reasonably priced lawyer. Additionally, be sure to ask your lawyer questions and take notes during any legal consultations to avoid additional fees. Moreover, it is important to be proactive and organized when it comes to filing paperwork or submitting documents to the relevant authorities. Taking the time to understand the process and being proactive can help reduce legal fees.

How Credit Score Penalties Will Affect You

One of the hidden costs of insolvency is a reduced credit score. Credit scores are important because they reflect an individual’s creditworthiness, and a low credit score can mean difficulty in obtaining credit, loans, mortgages, or insurance. The severity of the penalty to your credit score will depend on the extent of your insolvency. Generally speaking, filing for bankruptcy will have the greatest negative impact on your credit score, while other forms of insolvency will have a lesser effect.

The insolvency penalty to your credit score is not permanent, but you should expect your rating to take a hit. The penalty is usually in effect for a period of up to seven years after the filing, and during this time, it will be more difficult to get loans, mortgages, and other forms of credit. Additionally, the penalty may continue to have an effect even after the seven-year period has passed, as lenders may still consider it in their decisions to offer credit or not. It is therefore important to take steps to minimize the impact of insolvency on your credit score and to repair your credit as soon as possible.

Minimizing Costs to Get Back On Your Feet

Getting back on your feet financially can be a daunting task after a period of insolvency. It is important to remember, however, that the costs associated with insolvency can be minimized. Taking proactive steps to reduce costs is the best way to get back on your feet financially.

One way to minimize costs is to negotiate with creditors. Negotiating payment plans with creditors and credit card companies, for example, can help reduce debt and allow for more manageable payments. Additionally, consolidating debt into a single loan with a lower interest rate can also help reduce costs, as well as streamline payment scheduling. Other ways to minimize costs include making sure to pay bills on time, using credit cards responsibly, and carefully monitoring expenses. Taking these steps can help keep costs low and get back on the right financial track.