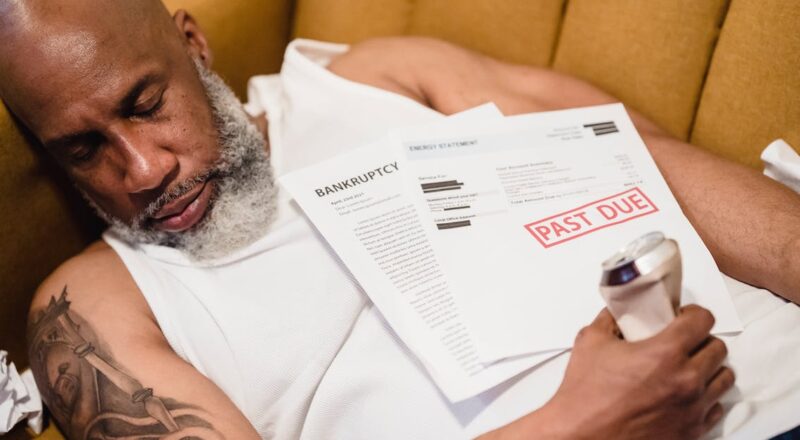

Insolvency is a situation where an individual or business is unable to pay their debts. It is a situation that many people may find themselves in, and understanding the process can be daunting. This article will provide a step-by-step guide to the insolvency process, including information on the different types of insolvency and the key roles of the people involved, such as creditors, insolvency practitioners, and debt advisors. It will also provide an overview of the different options available and advice on which option may be best for you. Taking control of your financial situation is the first step towards getting back on track, and understanding the insolvency process can help you to achieve this goal.

Know Your Options: A Guide to Insolvency Processes

Know Your Options: A Guide to Insolvency Processes is a comprehensive guide to understanding the insolvency process and how it affects individuals and businesses. This guide explains the different processes that can be used to help a person or company out of financial difficulty, and provides guidance on how to navigate through the process. It also provides information on the different types of insolvencies, such as voluntary and compulsory, and their respective effects on the individual or business.

This guide is designed to provide the reader with a greater understanding of their options and the consequences of each. It outlines the steps taken in each section of the process, from filing for insolvency to dealing with creditors, and provides advice on how to best manage the financial situation. Furthermore, the guide also covers topics such as restructuring, liquidation, debt settlement, and bankruptcy, as well as common pitfalls to avoid. Overall, this guide provides readers with a comprehensive overview of the insolvency process and helps them to make an informed decision about their financial future.

Take Charge of Your Finances: Navigating Insolvency

Insolvency can be a daunting and overwhelming process for individuals to go through, so it is important to be prepared. While the insolvency process may appear complicated, there are steps that individuals can take to help them manage the process and their finances. Individuals should take charge of their finances and make sure they understand their financial situation, including their debts and assets. This will include researching and understanding insolvency laws, calculating the amount of debt they owe, and seeking assistance from credit counseling services.

In addition, individuals will need to consider their budget and develop a plan to manage their financial situation. This may include setting up a budget that can be adhered to and cutting back on unnecessary expenses. Furthermore, individuals should look for ways to increase their income such as by taking on additional work or applying for government assistance programs. Lastly, individuals should reach out to their creditors and inform them of their financial situation and the steps they are taking to resolve it. This will help to ensure that individuals can work towards a fair and manageable repayment plan.

Insolvency Explained: Creditors, Practitioners, and Advice

Insolvency is a term used to describe a situation in which an individual or business cannot pay back their debts. When this occurs, a court or other competent body may declare them bankrupt, thus releasing them from further liability. It is important to understand the intricacies of the insolvency process and who is affected by it.

In order to understand the insolvency process, it is important to understand the three main players in the process: creditors, practitioners, and advisers. Creditors are the people or businesses to whom the debtor owes money. They are entitled to be repaid before anyone else. Practitioners are the professionals who are experienced in insolvency proceedings, such as insolvency lawyers or liquidators. They will assist the debtor and creditors in resolving the situation. Lastly, advice can be sought from a variety of sources, such as accountants or financial advisors. In some cases, they may be able to help the debtor avoid insolvency entirely. It is important to understand the roles and responsibilities of each of these players in order to navigate the insolvency process successfully.